So, Sirius Cybernetics Corp makes $1.82 for every dollar of assets. Let’s imagine the following values are for the year 2021. Let’s take the case of Sirius Cybernetics Corp (if you spotted the Hitchhikers reference, well done you!). Example of using the asset turnover formula This will give you your company’s asset turnover ratio. Step 3: DivideĪfter you have the figures for net sales and average total assets, divide them. Average total assets refer to the average value of your long-term and short-term assets for at least the past two fiscal years or the previous fiscal year. You can find this information on your accounting balance sheet. Step 2: Find the average of total assets. By doing this, you will get your net sales figure. So use your income statement to find your gross revenue and subtract sales returns, discounts, damaged goods, missing goods, lost goods, etc. The reason is that net sales refer only to products that have reached the hands of the customer. When calculating the asset turnover ratio, it is better to use net sales instead of gross sales. The formula is:Īsset Turnover Ratio = (Total Sales+ (Beginning Assets + Total Assets)/2) Step 1: Calculate your net sales. The asset turnover ratio formula is often applied to perform a yearly calculation.

#ASSETS TURNOVER RATIO HOW TO#

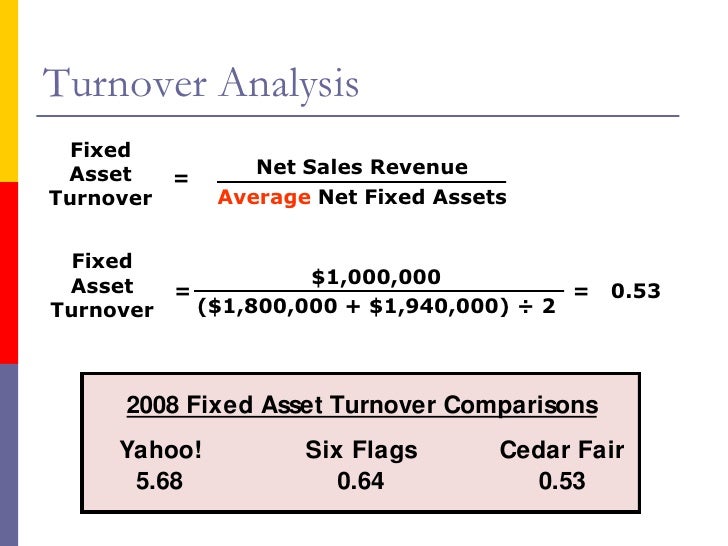

How to calculate total asset turnover – Asset turnover ratio formula However, the same is not true of a legal services company where the main currency is their legal knowledge. You always need to compare it with industry standards or companies of a similar size.įor example, manufacturing companies tend to have a much higher asset turnover ratio. Two, no number can be arbitrarily dubbed as a “good” or a “lousy” asset turnover ratio. One, intangible assets are excluded from the calculations. There are a couple of things to keep in mind when you calculate your asset turnover ratio. But, on the other hand, if the asset turnover ratio is low, they do not use their assets efficiently. If the asset turnover ratio is high, the company can generate a lot of revenue from its assets. It is an indicator of the efficiency with which a company can raise revenue through its assets. The asset turnover ratio measures the ability of a company’s assets to generate revenue or sales. Fixed assets benefit the operational efficiency of the organization. They also include intangibles like goodwill, copyrights, etc. Some common examples of fixed assets are company equipment, vehicles, real estate, etc. So let’s get to the crux of the matter right away! What are assets?Īssets are things that can’t convert easily into cash. Here’s everything you need to know about the asset turnover formula in detail.

0 kommentar(er)

0 kommentar(er)